Under the Tax Returns heading on the left hand pane of the main screen select View Calculation to view a summary (per HMRC form SA110) of your client's tax liabilities based upon information currently in the return.

Experiment with the various features in the Calculation toolbar.

In Year Calculator

This feature has been updated and improved to allow, inter alia, pension scheme contributions and charitable donations.

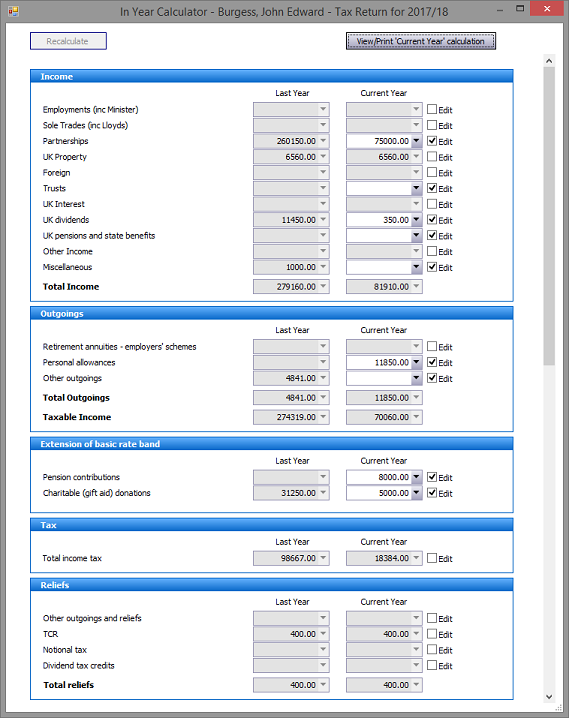

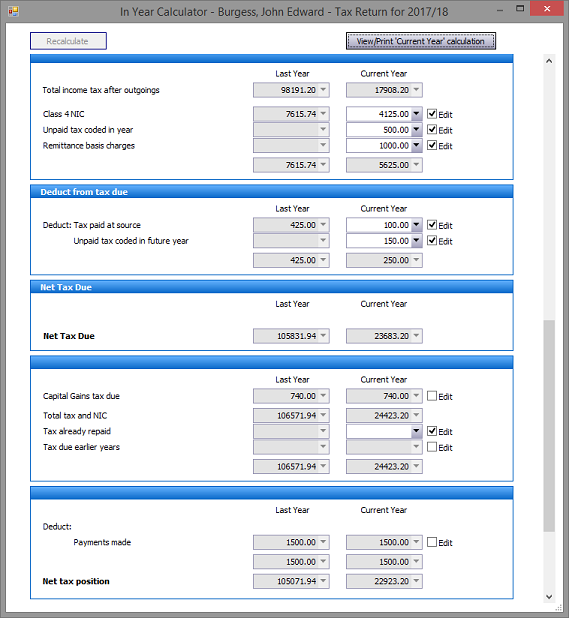

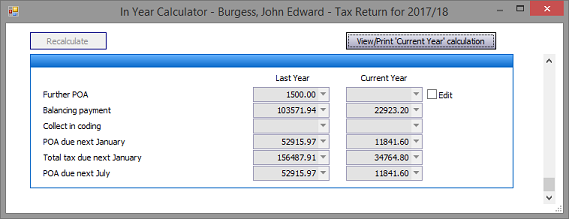

Click on the In Year Calculator button in the Calculation area in the left hand part of the Calculation toolbar which brings up the In Year Calculator screen.

Entries in the Last Year column (the return being worked on) are produced automatically. Initially entries in the Current Year column (the year subsequent to that being worked on) replicate those in the Last Year column. Checking any of the Edit tick boxes enables the existing entries to be overwritten as required.

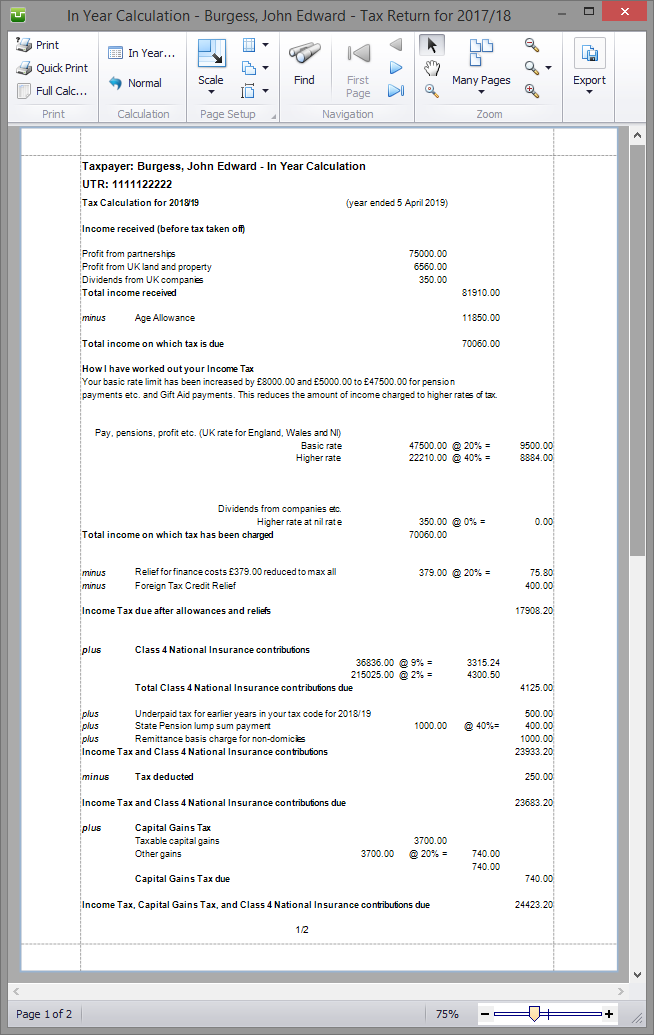

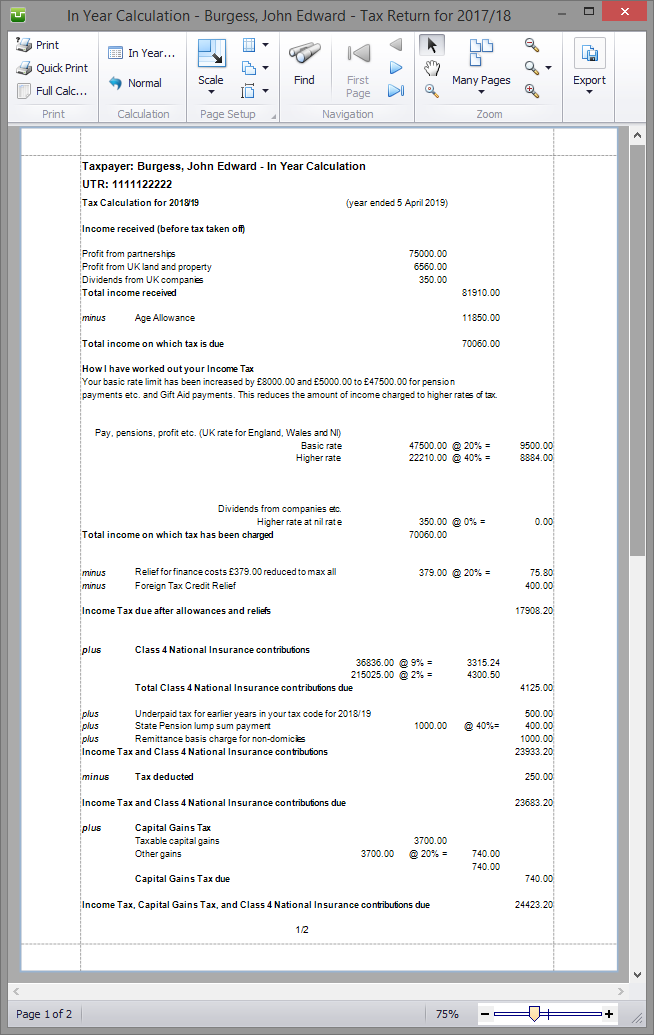

Select the View/Print 'Current Year' Calculation button to view a summary (per HMRC form SA110) of your client's tax liabilities.

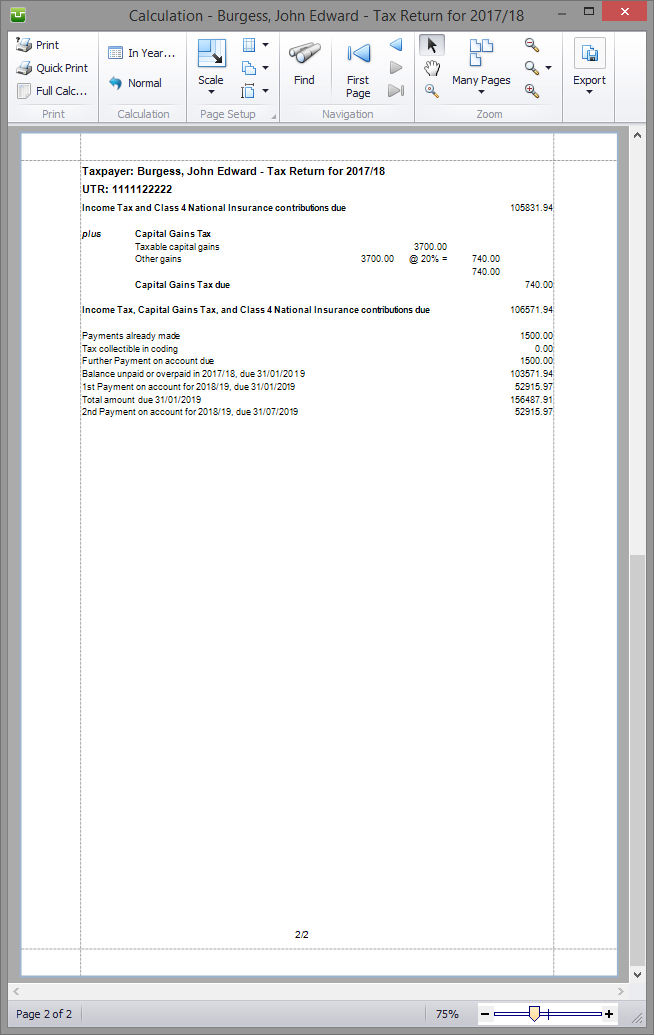

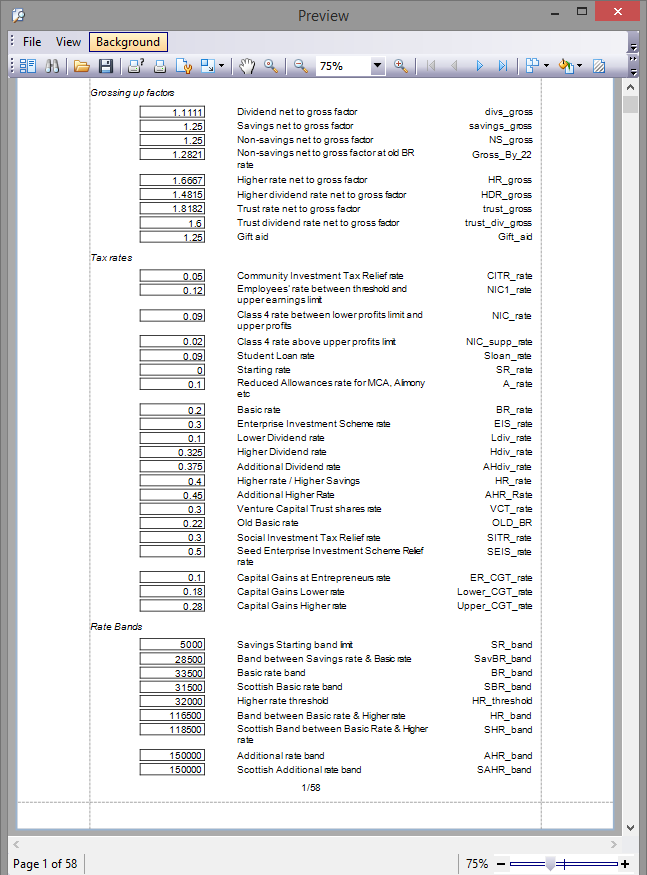

Click on the Full Calc button in the Print area in the left hand part of the Calculation toolbar to bring up the HMRC detailed calculation.

Please refer to the separate Individual Help Notes for more detailed information.

Copyright © 2025 Topup Software Limited All rights reserved.